Do you ever wonder if your job or business will allow you to build generational wealth?

Where would you start?

How would you even go about doing this?

I felt the same way when I started to earn 6-figures. Although I have a finance degree, an MBA, and years in Fortune500 Finance & accounting, I had to do a ton of extra research on this topic. I’m excited to share with you the answers to the questions above & these questions:

- How is it that the Rockefeller family was able to build generational wealth? How much is generational wealth today?

- What does the Bible say about generational wealth?

- How do you create generational wealth today?

- What is the generational wealth curse? And how do you avoid it?

One thing is clear, having money doesn’t make anyone financially literate, which is the foundation of building wealth. Growing up I didn’t know what financial literacy was. I saw my mother struggle to feed us as a single mom. I saw her selling our clothes and things around the house to get money for basic things. It was generational poverty rather than generational wealth. While on my financial journey, I realized how important it is to learn about money, the financial system, tax code, investing, and estate planning.

The Mistake Many People Make

The mistake that I see many people around me make is being stingy about paying for courses or for financial experts to help them. And, honestly, I was the same way. Because I grew up being told that universities are the best place to learn, there was no conversation about the importance of money knowledge. It was the opposite, money was considered evil, rich people were bad and any rich person trying to help you is trying to rip you off and make money off of you so don’t trust anyone. The biggest lesson I learned from this is that no one thinking this way can build wealth and more so generational wealth.

Eradicating The Lies That We Were Told For Generations

And that brings me to the first building block of building generational wealth which is eradicating the lies that we were told for generations. These lies are driving us today to get angry with people like Jeff Bezos or Elon Musk, thinking that the system is rigged, or they were born lucky or into wealth, or they cheated, took advantage of others, or they are smarter or better than you. And, because we are blinded by a set of money beliefs that were passed down to us, we have no room in our brain to question the truthfulness of those beliefs and how much they are stopping us from developing a healthy knowledge & relationship with money.

That is the most fundamental growth & change that we have to make in ourselves and pass it on to our children, so they can pass it on to the next generation and the next and next. The data shows that 70% of wealthy families lose their wealth by the 2nd generation and 90% lose wealth by the 3rd generation, and that’s because financial literacy was not passed down along with the money.

Before we go any further, I want to talk about something that I deeply struggled with. The infamous “money is evil” phrase that so many of us heard growing up and still hear today. These words are taken out of context from the bible.

What Does The Bible Say About Generational Wealth? And Money?

It says that “the love of money is evil” and not “money is evil.” This is a very important difference because money in itself doesn’t carry any positive or negative connotation. It’s not the money, it’s in whose hands the money is. If the person with money is generous, they will be even more generous. And, if the person is bad, then they will become even worse. Also, the bible is very clear about generational wealth, in Proverbs 13:22 says that a good man leaves an inheritance for his children’s children. God designed us to live a purposeful life and leave a legacy. This isn’t about fame, power, or ego. Instead, it’s giving glory to God by serving the next generation. As a parent, I don’t look at my kids and wish for them to be poor & suffering.

Do you ever wish that for your child or for anyone that you deeply love? I don’t think you do. That’s why we want to put our kids in the best schools, dance classes, sports, STEM, and give them the best of what we didn’t have. So many parents work very hard to give their kids the best of the best. So, if we do this for our kids, then why did we buy into the idea that God who created us and loves us beyond our imagination wouldn’t want us to live a wealthy, abundant, and prosperous life? Of course, he does want wealth & prosperity for us and our entire family of generations. In essence, we have a God-given moral obligation to set up financially our family generations.

How Much Is Generational Wealth?

To get to the answer, we have to learn about the two pieces that make up generational wealth.

The first piece, which is the second building block of generational wealth but almost no one talks about it. It’s this that the Rockefellers also have done well to continue passing down their wealth to the next generation. Families that create lasting legacies build a strong family culture and establish a shared sense of purpose that all members are clear on, support and together they move towards together. The Rockefellers have a family meeting every year, where they go over the purpose, the shared values, and the plans to continue growing and passing down their wealth.

The second more tangible piece, which is the third building block of generation wealth is financial assets passed from one generation of a family to another. Those assets can include real estate, stocks, cash, bonds, other investments, and family businesses.

What I realized is that many people, including myself, think that the hard part is accumulating cash, stock, real estate, etc. And this can’t be further from the truth. While accumulating these assets might not be easy, it’s the family values, culture, and purpose that it’s the hardest to establish now, think of Thanksgiving family gatherings, you know what I am talking about. But, also carry those intangibles forward for many generations to come.

Now that you understand these pieces, you probably now realizing that there is no definitive number that represents generational wealth because wealth is relative. The amount of passed-down family wealth depends on those who receive it, their financial literacy level, their commitment to family culture and purpose, and the way they grow & spend that wealth.

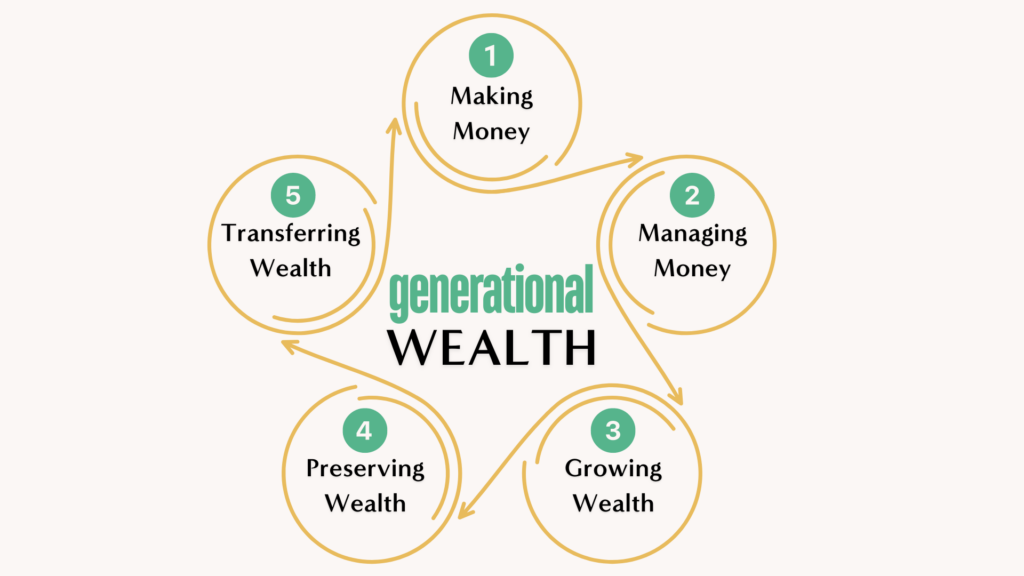

How Do You create Generational Wealth? (5 Skills Cycle)

Skill 1: Making Money

At the heart of generational wealth creation is the 5 skills cycle which starts with the Making Money skill. This is getting a college degree and a job or starting a business. Either way, the goal of getting good at making money is to create active income. Without active income, It’s not possible to create wealth. Even though this is obvious to some of us, there are a lot of people who struggle to make a good income. According to Statista, just over 50% of Americans are making less than $75k a year. Even high earners often hit a ceiling and struggle to break through to higher income levels. High-income earners have learned this skill well and the challenge here is to help our children to learn the skill of making money.

Skill 2: Managing Money

The next skill is the skill of Managing Money. If not learned by us and our kids, this becomes the generational wealth curse. This is a worldwide phenomenon that stops many from building wealth today and families who initially build significant wealth over time see their wealth significantly decrease through poor money management. The skill of managing money is different than making money because many of those who make money fall into lifestyle inflation to keep up with those around them. And statistics today reflect this hard truth. The reason this happens, we were not taught how to manage our money growing up, but as adults we have the power to take the steps we need to learn via courses, hire financial experts, and other ways.

Honestly, I had to change my mindset around this too. Because growing up in a poor environment I believe that there is plenty of information for free and I don’t need to pay to learn. Yes, there is plenty of information, an overwhelming amount of information to the point that we do nothing. This made me realize that everyone has access to the information at their fingertips, but very few are wealthy. So, information alone doesn’t drive change, but getting into the game, having skin in the game, and surrounding yourself with wise advisors gets results.

Skill 3: Growing Wealth

This is true for the next skill which is growing wealth by investing. No one builds wealth and more so generational wealth on salary and saving alone, because inflation eats at it. Many people feel uncomfortable investing because they are afraid of losing money. And, this is a legitimate feeling, I get it. I didn’t and don’t want to lose money either. But the reality is we lose to inflation, and it takes hundreds of years to save to become wealthy. If every generation will focus only on savings, the money will be gone faster than we can transfer it to the next generation. Investing our money to grow wealth and pass it on is not a luxury it is an absolute necessity.

Skill 4: Preserving Wealth

There comes a point in our life when we get older and for our sake, we need to go in wealth preservation. This is a skill where we lower the risk level of our investments because we need a portion of the money to still live on and we are not in a position to make riskier investments like we do when we are young.

Skill 5: Transferring Wealth

The last skill that we need to learn is the wealth transfer to the next generation. And here we are not talking just about the estate planning part which is crucial, but also about other intangible skills that the children would need to go through the generational wealth skill cycle, including every generation after them.

That brings me back to the two most important core building blocks of generational wealth which I mentioned at the beginning, family value plus purpose and financial literacy. But, there is one more important thing that is a must if you want you and your generations to prosper, live and an abundant, peaceful, and happy life. It’s a great lifelong lesson to learn to appreciate what we and our kids have even more. And, that is to generously give, and give and give to those that are in need.

This entire framework is how Unshakable Wealth is build for us and generations to come.

Join the ONE FREE Unshakable Wealth Newsletter

You will want to open in your crowded inbox every week because it will actually MAKE YOU MONEY & MAKE YOU SMART WITH MONEY.